The post EPA Releases Updated Edition of Climate Change Indicators Report appeared first on VelocityEHS.

]]>

By Phil Molé, MPH

In July 2024, EPA published the fifth edition of their report Climate Change Indicators in the United States, describing the ways climate change is impacting human health and the environment. The climate change indicators report draws from EPA’s research as well as other scientific literature, and its findings may inform policy decisions addressing climate risks and add to expectations for companies to more responsibly manage and report their carbon footprints.

Read on for high-level findings in EPA’s latest climate change indicators report, and takeaways for EHS and sustainability managers.

Summary of EPA’s Revised Climate Change Indicators Report

The purpose of EPA’s report is to present evidence of the far-ranging impacts of climate change and guide present and future actions to reduce levels of GHG emissions. This report presents excerpts from a larger set of climate change indicators. EPA’s full suite of 57 indicators is available here.

Here are some of the major findings presented in the latest climate change indicators report.

Trends in Greenhouse Gas (GHG) Emissions

It makes sense to start this discussion with GHGs, because as their name implies, GHGs in the atmosphere prevent sunlight reflected from earth’s surface from radiating back into space, trapping light energy the way a greenhouse does. Scientific consensus is that buildup of GHGs in the atmosphere, in large part due to human activity, has contributed to accelerating increases in average global temperatures, as well as related effects on climate and human communities.

Awareness of the central role of GHGs in climate change have led regulatory agencies such as Securities and Exchange Commission (SEC) in the US and European Financial Reporting Advisory Group (EFRAG) in the EU to develop regulations requiring certain companies to track and regularly disclose their GHG emissions.

Here are some of the key findings about trends in GHG emissions from EPA’s climate change indicators guide:

- According to EPA’s Global Greenhouse Gas Emissions indicator, global emissions of all major GHGs increased between 1990 and 2015. Gross emissions of carbon dioxide increased by 58 percent between 1990 and 2020, which is particularly impactful because carbon dioxide accounts for about three-fourths of total global emissions.

- Carbon dioxide emissions are increasing faster in some parts of the world (for example, East Asia and the Pacific) than in others. Emissions from three regions (East Asia/Pacific, Europe/Central Asia, and the US collectively represented 75 percent of total global emissions in 2020.

- In 2022, US GHG emissions totaled 6,343 million metric tons (14.0 trillion pounds) of carbon dioxide equivalents. This is a 3 percent decrease since 1990, due to factors such as increased energy efficiency and decreased carbon intensity of energy sources (mainly in non-transport sectors).

- There was a sharp decline in US GHG emissions from 2019 to 2020, but that was largely due to the impacts of the coronavirus (COVID-19) pandemic, including shutdowns, on travel and economic activity. Notably, emissions increased 5.7 percent from 2020 to 2022 as the economy rebounded.

- The transportation sector accounts for the largest share (28 percent) of 2022 emissions, followed by electric power/power plants (25 percent), industry (23 percent), agriculture (10 percent), the commercial sector (7 percent), and the residential sector (6 percent).

- Since the beginning of the industrial era, carbon dioxide concentrations have risen from an annual average of 280 parts per million (ppm) in the late 1700s to 419 ppm in 2023.

Temperatures Are on the Rise

Scientists had long predicted that increasing concentrations of GHGs in the atmosphere would lead to increases in average global temperatures, and the data continues to bear that out.

Here are some of the statistics on temperature increases from EPA’s climate change indicators guide.

- Global average surface temperature has risen at an average rate of 0.17°F per decade since 1901. The rate of warming within the contiguous 48 US states has been similar for most of this time, but since the late 1970s, the US has warmed faster than the planet as a whole.

- Worldwide, 2023 was the warmest year on record, 2016 was the second warmest, and 2014–2023 was the warmest decade on record since thermometer-based observations began.

- Heat waves are occurring more often across 50 major cities measured, including Chicago, Dallas, Miami, Boston, Phoenix, Memphis, and Seattle. Heat wave frequency has increased steadily, from an average of two heat waves per year during the 1960s to six per year during the 2010s and 2020s.

As the report succinctly puts it, “’unusually hot’ summer days and nights are not that unusual anymore.”

Trends in Extreme Weather Events

Rising global temperatures associated with climate change don’t just make the weather hotter—they also make it weirder. That is, as average global temperatures increase, so does the likelihood of extreme weather events such as hurricanes, wildfires, floods and droughts, and heavy rainstorms.

Here are some of the more alarming facts included in EPA’s most recent climate indicators report.

- The prevalence of extreme single-day precipitation events stayed fairly steady between 1910 and the 1980s but has risen substantially since then. In recent years, a larger percentage of precipitation has come from intense single-day events. Looking at more than 100 years of data, nine of the top 10 years for extreme one-day precipitation events have occurred since 1995.

- According to National Interagency Fire Center data, all 10 years with the largest acreage burned have occurred since 2004, including peak years in 2015 and 2020. This period coincides with many of the warmest years on record nationwide. The largest increases have occurred during the spring and summer months.

Impacts on Oceans

The total amount of heat stored by the oceans is called “ocean heat content,” and measurements of water temperature reflect the amount of heat in the water at a particular time and location. Ocean heat content is an important climate change indicator because oceans play an important role in mitigating climate change by absorbing excess heat and transferring it around the world. However, increasing ocean temperatures reduce the ocean’s ability to absorb heat and undermine its ability to mitigate the effects of climate change. Additionally, ocean temperature increases change ocean currents, which influence climate patterns and the health of ecosystems that depend on certain temperature ranges and movement of nutrients.

Here are some of the findings in EPA’s new climate indicators report about ocean temperatures:

Ocean temperatures

- Sea surface temperature increased during the 20th century and continues to rise. From 1901 through 2023, temperature rose at an average rate of 0.14°F per decade.

- Sea surface temperature has also been consistently higher during the past three decades than at any other time since reliable observations began in 1880. The year 2023 was the warmest ever recorded.

- Several marine species have shifted northward since the 1980s, including several economically important species. In waters off the northeastern United States, American lobster, red hake, and black sea bass have moved northward by an average of 145 miles. In the Bering Sea, walleye pollock, snow crab, and Pacific halibut have generally shifted away from the coast since the early 1980s and moved northward by an average of 41 miles.

- Between 1982 and 2023, the annual cumulative intensity of short-term spikes in ocean temperatures (known as “marine heat waves”) has increased in most coastal U.S. waters, with the largest changes in waters off the northeastern U.S. and Alaskan coasts.

Sea levels are a useful indicator because climate change tends to increase ocean levels through several different mechanisms. There’s a direct physical reason, because water expands as it warms, which causes ocean levels to rise. Heavy rainfalls, more common due to climate change, can also increase ocean levels. However, the most impactful factor contributing to rising sea levels is the melting of ice sheets and glaciers as average global temperatures increase. Of course, rising sea levels bring other risks, including risks to coastal communities.

Rising seas

- Glaciers worldwide have been losing mass since at least the 1970s, which has contributed to measured changes in sea level. A longer measurement record for a smaller number of glaciers suggests that they have been shrinking since the 1950s. Additionally, the rate at which glaciers are losing mass appears to have accelerated since the early 2000s.

- Although ice sheets naturally fluctuate with seasonal variations in temperature, precipitation, and other factors, the overall shrinking of the ice sheets far exceeds seasonal and year-to-year variations.

- The total amount of ice lost by Greenland and Antarctica from 1992 to 2020 was enough to raise sea level worldwide by an average of roughly three-quarters of an inch or more. By comparison, when factoring all contributions to sea level rise, global average sea level increased by about 3 inches overall during this period.

It’s important to note that another major effect of climate change is that increasing GHG emissions increase the concentration of dissolved carbon dioxide in ocean water, which leads to harmful effects on marine ecosystems. Rising levels of dissolved carbon dioxide increase the reaction of carbon dioxide with sea water to produce carbonic acid, which also decreases pH (i.e., increases acidity) and changes the balance of minerals in the water, making it more difficult for corals, some types of plankton, and other creatures to produce calcium carbonate, which is the main ingredient in their hard skeletons or shells. This is why climate change has such a harmful effect on coral reefs, as well as all the organisms dependent on them within the ecosystem.

Temperature Trends in Alaska

EPA’s U.S. and Global Temperature indicator shows that Alaska has warmed more quickly than any other state over the past century. Regionally, Alaska’s North Slope has warmed at the fastest rate of all. Alaska has also warmed more quickly than the global average. Here are some stats from EPA’s climate change indicators report:

- The sea ice extent measured in September 2023 was the fifth smallest on record. It was about 789,000 square miles less than the historical (1981–2010) average for that month—a difference almost three times the size of Texas. The lowest sea ice extent ever was recorded in September 2012.

- The length of the melting season for Arctic Sea ice has grown by 37 days since 1979. On average, Arctic Sea ice now starts melting seven days earlier and starts refreezing 30 days later compared to historical trends.

- EPA’s Permafrost indicator shows that between 1978 and 2022, permafrost temperatures increased at 14 out of 15 locations measured across Alaska

- Data for three Alaskan rivers demonstrate long-term trends toward earlier ice breakup in the spring. Looking at the average change over all years of data, the ice breakup dates for all three rivers have shifted earlier by eight to nine days. At all three locations, the earliest breakup dates ever recorded have occurred within the past four years.

What are the Major Takeaways from EPA’s Climate Change Indicators Report?

EPA’s latest climate change indicators report paints a sobering picture of the impacts of climate change. Not only are average global temperatures increasing, but so are levels of GHG emissions. The report also documents the increasing prevalence of extreme weather events, and rising ocean temperatures and sea levels, which threaten marine biodiversity and the safety of coastal communities. Rising temperatures also increase usage of heating, ventilation and air conditioning (HVAC) systems (where available), which in turn consumes more electrical energy, and results in more GHG emissions in a vicious circle.

Climate change also impacts many other areas of EHS and Environmental, Social and Governance (ESG). Increasing temperatures are increasing risks of heat-related occupational injuries and illnesses, which is one reason why OSHA has recently published a proposed rule to protect employees in both outdoor and indoor work environments from heat exposure.

Let’s also remember that the effects of climate change don’t impact human populations equally. Populations who are socially vulnerable due to economic inequality or racial discrimination generally have both fewer resources to offset the immediate impacts of climate change, such as access to HVAC systems or community-based resources, and also experience the worst impacts of climate change, including disproportionate exposure to flooding risks or the impacts of hurricanes and tropical storms.

The climate change indicators report includes this very useful summary:

“Climate change is affecting the environment in ways that have significant impacts on the health and well-being of people and ecosystems. For example, as temperatures increase, the frequency of extreme heat days and heat waves also increases, which puts people at greater risk for heat-related illnesses and deaths. Less snowpack and increased glacier melt affect water resources for both ecosystems and human use. Changes in the timing and character of seasons affect the number of days suitable for growing crops and increase pollen that triggers seasonal allergies. These changes will not be experienced equally, as some communities have faced and will continue to face disproportionate impacts of climate change due to existing vulnerabilities, including socioeconomic disparities, historical patterns of inequity, and systemic environmental injustices.”

Let VelocityEHS Help!

EPA’s latest climate report will likely raise awareness of the wide-ranging impacts of climate change and add to growing demands from stakeholders for companies to track and disclose their GHG emissions. These expectations exist alongside a growing number of regulations requiring some companies to report their GHGs emissions and may increase the perceived need for additional regulatory oversight. Now is the time to reassess what systems and technology tools your organization relies on to collect, analyze, and report GHG data to regulators, investors, and other stakeholders.

The Velocity’s GHG and Energy Management software allows you to automate and simplify the collection, validation, and reporting of your greenhouse gas and energy data, eliminating many of the administrative burdens that come with quantifying and disclosing your organization’s emissions and other climate risks. You can also easily generate the investor-grade data you need for compliance, while flexible reporting features help you manage shifting climate policies and disclosure requirements, as well as investor and supply-chain partner information requests.

Don’t wait to get your climate risk disclosure data in order. Request a Demo today and see firsthand how VelocityEHS can put your organization on a firm footing for compliance.

The post EPA Releases Updated Edition of Climate Change Indicators Report appeared first on VelocityEHS.

]]>The post California’s ESG Disclosure Rules: What You Need to Know appeared first on VelocityEHS.

]]>

By Phil Molé, MPH

California has become the first US state to issue ESG disclosure requirements. While many EHS and ESG managers and company leaders may be understandably focused on disclosure regulations emerging at the national level, California’s ESG disclosure rules are a reminder that anyone managing their company’s ESG governance needs to be aware of and prepared for state requirements, as well.

This blog breaks down California’s ESG disclosure rules and provides some major takeaways for EHS professionals.

What Do California’s ESG Disclosure Rules Require?

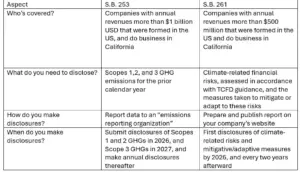

California Governor Gavin Newsom signed the ESG disclosure rules in October 2023.There are two separate ESG disclosure rules, with requirements breaking down as follows:

1) SB 253, the “Climate Corporate Data Accountability Act,” requires some companies to disclose all three scopes of their greenhouse gas (/GHG) emissions. The term “scopes” describes the sources of GHG emissions relative to a company’s operations, based on definitions and guidelines established the GHG Protocol, an organization that publishes accounting guidelines that organizations around the world use to identify and track their GHG emissions inventory. Scope 1 GHGs are those directly emitted by a company’s operations, Scope 2 GHGs are indirect emissions associated with purchased utility energy, and Scope 3 emissions are associated with the company’s value chain, from sources either upstream or downstream of the company’s operations. SB 253 states that organizations required to disclose their GHG emissions must submit their reports to a nonprofit emissions reporting organization contracted by the California Air Resources Board (CARB). Further details about the specific organizations that will receive and manage these reports will likely follow as the compliance timelines get closer.

S.B. 253 applies to companies doing business in California that generate annual revenues of more than $1 billion. The rule itself does not provide details on the specifics of making disclosures, designating CARB to develop and issue implementation regulations, and stipulating that CARB must issue these regulations on or before January 1, 2025. The rule also authorizes enforcement mechanisms for CARB, including penalties for non-filing, late filings, or other failures to meet disclosure requirements.

2) SB 261, “The Climate-Related Financial Risk Act,” will require certain companies to disclose climate-related financial risks in accordance with Task Force on Climate-Related Financial Disclosures (TCFD) guidelines published in 2017. Affected companies will also need to disclose the measures they’re taking to mitigate or adapt to identified climate-related financial risks. SB 261 stipulates that companies subject to these disclosure requirements will need to provide the disclosures in a report made publicly available on the company’s website. If for any reason a company subject to SB 261 is unable to provide the required information, they would need to report what they can to the best of their ability, explain the reasons for any gaps, and describe the steps they will take to fully comply. Note that although TCFD disbanded as an organization in late 2023, TCFD guidance remains widely in use, as the referencing of TCFD framework within SB 261 shows. The International Sustainability Standards Board (ISSB) now oversees implementation of TCFD guidance and encourages its continued use by organizations for identification of climate risks and opportunities.

One unresolved question at this point is whether SB 261 specifically requires covered companies to conduct scenario analysis or to disclose if they’ve conducted one. Scenario analysis is a specific type of climate-based risk assessment exercise that involves considering how different consequences, or scenarios related to climate change could potentially impact a company’s revenues and business resilience. For example, climate change brings physical risks, such as extreme weather events that could either directly damage the company’s facilities or interrupt supply chains, as well as marketplace risks, such as shifts in customer preferences toward higher energy efficiency or cleaner energy-using products. While the words “scenario analysis” don’t appear in the text of SB 261, the 2017 TCFD guidance referenced in the bill as the basis companies should use for assessing climate risks does reference scenario analysis as a preferred climate risk assessment method. This is another area where more specific implementation guidance is expected.

SB 261 applies to companies formed in the US that do business in California and generate annual revenues greater than $500 million.

It should be noted that the text of both bills states that they apply to companies “doing business in California” without defining what exactly it means, but since a Senate Floor Analysis Memo for SB 253 references the California Revenue and Tax Code, we can infer that the definition there is probably the one that applies here. The Revenue and Tax Code defines “doing business in California” as “actively engaging in any transaction for the purpose of financial or pecuniary gain or profit” in California; being “organized or commercially domiciled” in California; or having California sales, property or payroll exceeding specified amounts. As we move closer to the implementation timeframe, the state of California may issue additional clarifications and guidance. The chart below summarizes some of the major details about the two bills.

When Do California’s ESG Disclosure Requirements Go into Effect?

Companies subject to SB 253 would need to disclose Scopes 1 and 2 GHG emissions by 2026, and obtain limited assurance for their data, and provide reasonable assurance by 2030. Affected companies would need to start disclosing their Scope 3 GHG emissions by 2027 and obtain limited assurance for Scope 3 disclosures by 2030.

Those companies subject to SB 261 would need to provide their first disclosures by 2026 and would need to provide the disclosures every two years thereafter.

Of course, it is still possible that California will push out the compliance timeline, revise requirements, or at the very least, publish clarifications or implementation guidelines. For example, in his signing statement for SB 253, Governor Newsom states that, “the implementation deadlines in this bill are likely infeasible, and the reporting protocol specified could result in inconsistent reporting across businesses subject to the measure.” The statement also notes that Governor Newsom’s administration would be working with the bill’s author and the California state legislature during 2024 to address these issues. Even so, it’s safe to assume that the requirements themselves are staying in place, and businesses affected by these two California climate disclosure rules will need to start preparing now.

Will Other States Be Drafting ESG Disclosure Requirements?

The short answer is “probably.” As of this writing, other states are considering regulations similar to California’s ESG disclosure rules, including Illinois and Washington. While no bills have been signed yet in other states, there are indeed already rulemakings in their early stages in other states.

For example, an Illinois state representative has proposed a Climate Corporate Accountability Act (HB 4268), which would require US companies that generate over $1 billion in annual revenue and do business in Illinois to disclose Scopes 1-3 GHG emissions as defined by the GHG Protocol standards. As written, the bill would require affected companies to disclose Scopes 1 and 2 GHGs by January 1, 2025, and Scope 3 GHGs within an additional 180 days. If Illinois passes this law, the Secretary of State will adopt reporting and verification rules by July 2024 and contract with an emissions registry provider to establish an internet disclosure platform by January 2025. Finally, companies required to make disclosures must verify their emissions through an emissions registry or third-party auditor.

Judging by the example of California’s ESG disclosure rules and the subsequent discussion of them, these deadlines may be too ambitious, and subsequent clarifications or revisions of these proposed requirements may be necessary as the bill continues its journey toward being signed into law, if in fact it does. But also judging by California’s example, there’s a good chance that some version of these requirements will go into effect, not only in Illinois but in other states.

What are the Main Takeaways About California’s ESG Disclosure Requirements?

There are many moving parts to California’s ESG disclosure rules, as well as to the world of GHG disclosures generally. Here are some key takeaways.

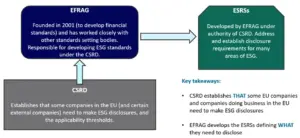

Climate disclosure requirements are here to stay. You may be hearing and reading a lot about pushbacks on ESG or the idea that ESG is “going away,” but the growing number of global regulations requiring ESG disclosures tells a different story. For example, the Corporate Sustainability Reporting Directive (CSRD) is now in effect and requires tens of thousands of EU and EU-listed companies to prepare ESG disclosures based on the European Sustainability Reporting Standards (ESRSs) developed by European Financial Reporting Advisory Group (EFRAG). In the United States, Securities and Exchange Commission (SEC) has recently announced the finalization of its disclosure rules for publicly listed companies, which require those companies to report details of their management of climate risks and opportunities.

The point here is that climate disclosure regulations are becoming more of a thing, not less of a thing. You should probably accept that GHG disclosures are here to stay and recognize that a commonality across these regulations is the mandate for companies to assess relevant climate risks and to disclose GHG emissions.

Even if these requirements don’t apply to you, pressure to provide climate disclosures is increasing. Your company may not be subject to the California disclosure rules, or any of the other existing or forthcoming disclosure requirements discussed in this article, but that doesn’t mean they won’t affect you. For one thing, one or more of your value chain partners may be subject to these requirements, and if so, they will need your company to document and provide climate-related data so that they can meet their disclosure requirements. For another, potential investors in your business and financial institutions you may approach for business loans will likely want to see documentation of your ESG governance when making decisions. Finally, you can’t discount the preferences of your customers and prospects, who increasingly are using evidence of corporate ESG performance to decide which businesses to support.

Companies will need to prioritize collecting and reporting good GHG data. Because of the increasing number of disclosure requirements and increasing pressure from many fronts, company leaders should start collecting GHG data, or improve their existing processes. Many businesses lack efficient processes for collecting and managing data, especially for Scope 2 and Scope 3 GHGs. Scope 2 GHG tracking requires an efficient and accurate method of collecting data from their utility companies, which can be difficult if you’re still working with paper copies or manually performing emission factor calculations. Tracking of Scope 3 GHGs poses even more problems because the sources are downstream or upstream of your operations.

Of course, you’ll also need to organize your data into the right format to meet reporting requirements. It is possible that a company could be subject to more than one regulation and would need to meet the requirements of several distinct, if overlapping, disclosure regulations—e.g., a US public company that does business above applicable thresholds in California and EU could need to prepare disclosures in accordance with SEC, California and CSRD requirements. Luckily, the types of reporting required under all these regulations are broadly similar and are also similar to the disclosures under voluntary frameworks such as Global Reporting Initiative (GRI), ISSB, and the Sustainability Accounting Standards Board (SASB) standards currently overseen by ISSB.

Let VelocityEHS Help!

Are you looking for help collecting and reporting GHG emissions data? Now is the perfect time to reassess the systems and technology tools your organization relies on to collect, analyze, and report climate risk information to regulators, investors, and other stakeholders to reduce risks of non-compliance and boost the confidence of your value chain partners, investors and customers in your ESG governance.

The GHG & Energy Management capabilities in the VelocityEHS ESG Solution allow you to automate and simplify the collection, validation, and reporting of your utility energy data. You can choose and apply the correct emissions factors from an updating library and perform correct unit conversions eliminating much of the administrative burden and potential error associated with manual data management. You’ll also have out-of-the-box reporting capabilities aligned with major disclosure frameworks but flexible enough to meet shifting or emerging disclosure requirements with the investor-grade data you need to demonstrate compliance to satisfy investor and value-chain partner information requests.

Don’t wait to get your climate risk disclosure data in order. Request a Demo today and see firsthand how Velocity can put your organization on a firm footing for compliance.

The post California’s ESG Disclosure Rules: What You Need to Know appeared first on VelocityEHS.

]]>The post SEC Announces Climate Disclosure Rule Requiring GHG, Climate Risk Reporting from Publicly Traded Companies appeared first on VelocityEHS.

]]>

Update: The US Securities and Exchange Commission (SEC) published its final rule for The Enhancement and Standardization of Climate-Related Disclosures for Investors to the Federal Register on March 28, 2024.

On March 6, 2024, the US Securities and Exchange Commission (SEC) announced it would adopt a final version of its climate disclosure rule requiring publicly traded companies to assess and publicly disclose information regarding their climate impacts including GHG emissions and other climate-related financial risks. The long-awaited announcement of the SEC final rule comes nearly two years after the Commission published its proposed climate disclosure rule in 2022.

SEC Climate Disclosure Rule Background

Over the last decade or so, major institutional investment houses and large corporations have increasingly added climate risks into their financial calculus, not only in response to investor demands for greater environment, social, and governance (ESG) performance, but also due to the growing realization that climate risks have a quantifiable and direct impact on the long-term viability and sustainability of organizations, making them a significant factor in the overall risk levels that investors rely on to evaluate investments.

To quantify and standardize these risks, numerous climate risk disclosure frameworks and standards evolved within the marketplace and financial industry. Some of the more prominent names among these include the Global Reporting Initiative (GRI), TCFD, and SASB. However, these disparate climate risk and ESG disclosure frameworks lack standardization and are entirely voluntary, leading to variation and gaps in what data each of these frameworks was able to capture and communicate to investors and other interested stakeholders.

More recently, government regulators are beginning to recognize the challenges created by these disparate disclosure frameworks and have begun to develop and implement compulsory disclosure regulations to standardize publicly traded companies’ climate risk information for investors. In the EU, this has taken the form of the European Financial Reporting Advisory Group (EFRAG) European Sustainability Reporting Standards (ESRSs) which are currently being implemented at the national level by EU member states. Concurrently, the US SEC developed its own proposed rule, The Enhancement and Standardization of Climate-Related Disclosures for Investors. As of March 6, 2024, that rule is now final.

SEC Climate Disclosure Requirements

Regarding the Agency’s climate disclosure rule, SEC Chair Gary Gensler noted in the March 6, 2024 agency press release:

“These final rules build on past requirements by mandating material climate risk disclosures by public companies and in public offerings. The rules will provide investors with consistent, comparable, and decision-useful information, and issuers with clear reporting requirements. Further, they will provide specificity on what companies must disclose, which will produce more useful information than what investors see today. They will also require that climate risk disclosures be included in a company’s SEC filings, such as annual reports and registration statements rather than on company websites, which will help make them more reliable.”

The SEC climate disclosure rule would require public companies registered with the SEC to assess and report:

- Climate-related risks that have had or are reasonably likely to have a material impact on the registrant’s business strategy, results of operations, or financial condition;

- The actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model, and outlook;

- If, as part of its strategy, a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities;

- Specified disclosures regarding a registrant’s activities, if any, to mitigate or adapt to a material climate-related risk including the use, if any, of transition plans, scenario analysis, or internal carbon prices;

- Any oversight by the board of directors of climate-related risks and any role by management in assessing and managing the registrant’s material climate-related risks;

- Any processes the registrant has for identifying, assessing, and managing material climate-related risks and, if the registrant is managing those risks, whether and how any such processes are integrated into the registrant’s overall risk management system or processes;

- Information about a registrant’s climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition. Disclosures would include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal;

- For large accelerated filers (LAFs) and accelerated filers (AFs) that are not otherwise exempted, information about material Scope 1 emissions and/or Scope 2 emissions;

- For those required to disclose Scope 1 and/or Scope 2 emissions, an assurance report at the limited assurance level, which, for an LAF, following an additional transition period, will be at the reasonable assurance level; *

- The capitalized costs, expenditures expensed, charges, and losses incurred because of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements;

- The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements; and

- If the estimates and assumptions a registrant uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted, disclosed in a note to the financial statements.

(*A notable difference between the SEC’s proposed requirements and the final rule was the removal of requirements for companies to disclose Scope 3 greenhouse gas (GHG) emissions in addition to Scope 1 and 2 GHGs.)

The SEC press release notes that the final rule will become effective sixty (60) days after it is published in the Federal Register, with compliance and reporting deadlines for SEC-registered entities to be phased in after that date depending on their filing status and schedule.

As of this publication, the SEC climate disclosure rule has not been formally published in the Federal Register. Follow us on LinkedIn for the latest updates as soon as they become available. For more information on SEC climate disclosure rule requirements, global reporting standards and frameworks, GHG reporting, and all things ESG, visit the VelocityEHS Resources Page.

Are You in Compliance with SEC’s Climate Disclosure Rule? VelocityEHS Can Help!

If you’re a public company and you haven’t done so already, you need to start preparing for the SEC climate disclosure rule now! For privately owned organizations, keep in mind that even if you’re not an SEC-registered company, you likely partner with public companies who will be subject to the new requirements, and you may receive requests for climate risk information that they’ll need to meet their own compliance and reporting obligations.

Now is also the time to reassess what systems and technology tools your organization relies on to collect, analyze, and report climate risk information to regulators, investors, and other stakeholders. Without the right tools and an easy way to access and communicate that data, the risk for non-compliance is simply too great, especially if you’re not already capturing and documenting climate risk information.

The GHG & Energy Management capabilities of the VelocityEHS ESG Solution allow you to automate and simplify the collection, validation, and reporting of your greenhouse gas and energy data, eliminating many of the administrative burdens that come with quantifying and disclosing your organization’s emissions and other climate risks. You can also easily generate the investor-grade data you need for compliance, while flexible reporting features help you manage shifting climate policies and disclosure requirements, as well as investor and supply-chain partner information requests.

Don’t wait to get your climate risk disclosure data in order. Request a Demo today and see firsthand how VelocityEHS can put your organization on a firm footing for compliance.

The post SEC Announces Climate Disclosure Rule Requiring GHG, Climate Risk Reporting from Publicly Traded Companies appeared first on VelocityEHS.

]]>The post France Has Adopted the CSRD and Will Fine, Jail Noncompliant Company Directors appeared first on VelocityEHS.

]]>

By Phil Molé, MPH

France has become the first EU member to incorporate the Corporate Sustainability Reporting Directive (CSRD) into its national law. The CSRD, and along with it, the first European Sustainability Reporting Standards (ESRSs), went into effect on January 1, 2024, and the process of determining how to comply with these regulatory obligations just got even more difficult for affected EU and EU-listed companies now that France has adopted the CSRD.

In what follows, we’ll break down the details of France’s transposition of the CSRD and provide takeaways about how to prepare, as well as what this could soon mean for your business when it comes to ESG.

What Is the Background of the CSRD?

The European Commission accepted a proposal for a CSRD to revise the Non-Financial Reporting Directive (NFRD). At that time, the NFRD EU sustainability reporting framework established disclosure requirements for non-financial and diversity information by certain large companies. European Parliament and EU Council adopted the CSRD in December 2022, setting the stage for the development of specific sustainability reporting standards. A crucial part of that adoption is that all EU member states must formally adopt the CSRD and integrate the CSRD into their own national laws within 18 months, a time interval which will end in July 2024.

European Financial Reporting Advisory Group (EFRAG) is an EU organization founded in 2001 (to develop financial standards) and has worked closely with other standards-setting bodies. In a letter dated May 12, 2021, EU Commissioner Mairead McGuinness formally requested that EFRAG develop ESG standards under the CSRD. EFRAG issued its first set of draft ESRSs in April 2022.

The ESRSs address many areas of ESG, including not only greenhouse gas (GHG) emissions and general disclosure requirements, but also aspects of social sustainability. Social sustainability describes efforts to create and support healthy places inside and outside company environments, including relationships with communities and workers outside of the company’s own workforce. For example, EFRAG included a standard that addresses the management of workers in the value chain, such as suppliers and contractors, who might bear some of the impacts of the company’s operations. It also included a standard on “affected communities” that prompts companies to assess how their business operations impact community equity in terms of access to clean air, clean water, and adequate housing. The standards also widen the lens of environmental sustainability, tasking companies with understanding and mitigating their impact on marine life and biodiversity.

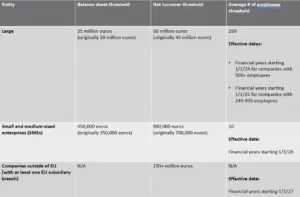

The EU adopted the final ESRSs after consultation with EU member states in June 2023. The ESRS create mandatory reporting obligations for over 50,000 EU and EU-listed companies, most of which had not currently been making ESG disclosures.

The relationship between the CSRD, EFRAG, and the ESRSs is shown in the diagram below.

Because the CSRD went into effect on January 1, 2024, the ESRSs are now also in effect, starting with the biggest EU companies as defined by financial characteristics. The chart below shows the categories of companies covered by the CSRD, and their applicable compliance timelines:

What’s Changing Now That France Has Adopted the CSRD?

Acting under the authority of Article 12 of French Law No. 2023-1714, which contains provisions for aligning French law with EU law in the fields of the economy, health, labor, transport, and agriculture (2023 DDADUE Law), French Order No. 2023-11425 (the French Ordinance) transposed the CSRD into national law. With this Order, France has become the first EU country to officially codify CSRD requirements.

To better understand France’s implementation of the CSRD, you first need to understand the obligations of companies required to prepare and submit sustainability reports under the CSRD.

Once a company prepares its sustainability reports, they must then have the information contained in their sustainability report certified by an “auditor” specialized in sustainability issues. This auditor may be a statutory auditor or an accredited independent third-party body, such as an authorized accountant or lawyer.

Through the process of adopting the CSRD, many French companies that had not previously needed to prepare and submit sustainability reports via the existing Extra Financial Performance Declaration (EFPD) requirements of the French Commercial Code will now need to do, with their reports certified by an auditor.

French Order No. 2023-11425 states that an injunction, subject to a penalty, may be sought by any “interested party” before Court under interim proceedings to obtain the “production, communication, or transmission of documents or information relating to sustainability, or the appointment of an agent to carry out such communication,” (e.g., the required sustainability reports). It may be too early to know how this process of seeking an injunction will be interpreted and applied, but by its plain language, the wording in the Order suggests the possibility of giving standing to many different potential parties, including shareholders, employees, community members, and customers (among others) in forcing the production of the required reports.

France’s enforcement mechanism also stipulates criminal sanctions in several cases, as described below:

- Failing to appoint an auditor or independent third-party organization, with a fine of up to €30,000 and imprisonment up to two years for company director(s) and a fine up to €150,000 for the legal entity;

- Failing to convene the auditor or independent third-party organization, with a fine of up to €30,000 and imprisonment up to two years for the company director(s) and a fine up to €150,000 for the legal entity;

- Obstructing audits or controls by the auditor or independent third-party organization or their experts, with a fine of up to €75,000 and imprisonment up to five years for the company director(s) and a fine up to €375,000 for the legal entity; and

- Refusing the auditor or independent third-party organization or their experts on-site access to all documents required for the performance of their duties and, in particular, to all contracts, books, accounting documents, and minute books, with a fine up to €75,000 and imprisonment up to five years for the company director(s) and a fine up to €375,000 for the legal entity.

As these provisions show, French companies subject to disclosure requirements will need to provide the mandated sustainability information in a timely manner. Of course, they’ll also only be able to meet these requirements if they have good sustainability data to start with and streamlined ways of organizing their data into disclosure reports.

What Information Will French Companies Need to Report?

It’s important to note that in adopting the CSRD, France is also adopting the double materiality concept that the CSRD and ESRSs apply. In the world of ESG, “materiality” means relevance, and there are two primary ways of measuring it.

An ESG issue has financial materiality if it impacts a company’s business performance or overall value. Financial materiality metrics may include revenues, turnover/units of product sold, or stock prices. If an ESG issue affects the world outside the company, such the economy, the environment, or communities, it has impact materiality. It should be noted that these two categories aren’t mutually exclusive, and many stakeholders would argue that issues that primarily affect impact materiality, such as air or water pollution, will likely also have financial materiality, whether in the form of fines, exposure to lawsuits, or loss of reputation and customer confidence due to bad publicity. The CSRD and EFRAG’s ESRSs are based on double materiality, which means that disclosures under France’s adoption of the CSRD will be based on double materiality, as well.

Considering the wider lens of materiality being applied, companies subject to France’s disclosure regulation will need to report a variety of different aspects of their ESG performance, including:

- How resilient the company’s business model and strategy are, regarding the risks associated with sustainability issues;

- The opportunities that sustainability issues present for the company;

- The company’s plans, including actions taken or contemplated and related financial and investment plans, to ensure the compatibility of its business model and strategy with the transition to a sustainable economy; the limitation of global warming to 1,5°C in accordance with the Paris Agreement adopted under the United Nations Framework Convention on Climate Change, and the objective of climate neutrality by 2050; and, if applicable, the company’s exposure to coal-, oil-, and gas-related activities;

- How the company’s business model and strategy consider stakeholders’ interests and the impact of the company’s activity on sustainability issues;

- How the company’s strategy is implemented regarding sustainability issues;

- The company’s time-bound sustainability objectives and progress towards these objectives, including, when appropriate, absolute GHG emission reduction targets at least for 2030 and 2050;

- The role of management, administrative, or supervisory bodies with regard to sustainability issues, as well as the skills and expertise of the members of these bodies in this respect, or the opportunities available to acquire them;

- The company’s policies on sustainability issues;

- The existence of incentive schemes a company grants to members of its management, administrative, or supervisory bodies in relation to sustainability issues;

- The due diligence process implemented by the company regarding sustainability matters and the negative impacts identified in this context, and, where applicable, in line with EU legislation;

- The main potential or actual negative impacts connected with the company’s own operations and with its value chain, the measures taken to identify, monitor, prevent, eliminate, or mitigate these negative impacts, and the results obtained; and

- The main risks of sustainability issues to the company, including its main dependencies, and the way in which it manages these risks.

Companies subject to these reporting requirements must submit their sustainability data in a specific section of their management report, as provided by Article L. 232-6-3 of the French Commercial Code. This section must also include a description of the process companies must follow to gather the relevant information.

Which French Companies Must Prepare Sustainability Reports?

The chart below breaks down the different categories of French companies and their applicable reporting timelines:

| Company category | Reporting year | Year that first reports are due |

| Large companies already subject to the DPEF | FY 2024 | 2025 |

| Other large companies | FY 2025 | 2026 |

| SMEs listed on a European regulated market, excluding micro-undertakings | FY 2026 | 2027 |

| Foreign groups | FY 2028 | 2029 |

Will Other EU Countries Incorporate the CSRD into Law?

As mentioned previously, EU’s adoption of the CSRD in late 2022 came with a provision for EU member countries to formally transpose the CSRD into their national laws within 18 months. This means that all EU member countries need to nationalize CSRD into their laws by July 2024, so we can expect to see other EU member countries incorporate the CSRD into their own national laws over the coming months.

Also, now that France has provided a structured example of what national implementation looks like, it’s fair to expect that many other EU countries will adopt similar legal mechanisms for enforcement, including potential fines and criminal sentences.

What Does France’s Adoption of the CSRD Tell Us About the Importance of ESG?

France’s adoption of the CSRD, and the forthcoming adoption by other EU nations, remind us that ESG isn’t going away anytime soon. Companies are finding that regulators, value chain partners, investors and customers alike see ESG disclosures as an integral part of business.

The transposition of the CSRD into law by EU countries is part of a growing trend of mandatory ESG disclosures. For example, non-EU countries like New Zealand and Hong Kong have already adopted ESG disclosure regulations. In the US, the Securities and Exchange Commission (SEC) has published a proposed rule that would require all companies registered with SEC (i.e., publicly listed companies) to disclose various aspects of their management of climate-related risks and opportunities, including business strategies they’re using, details about whether they’re following a climate transition plan, and their GHG emissions.

Even if you don’t yet face regulatory obligations to prepare and submit ESG disclosures, your value chain partners might, and they will be looking to ensure that anyone they conduct business with has the data to demonstrate their ESG performance. Investors and banks are also increasingly requesting ESG data to assess financial risks, determine whether to lend to individual organizations, and at what interest rate.

The bottom line is that if you’re not already making disclosures, you probably will be making them someday soon. Get a plan in place and evaluate the ability of your systems to collect and disclose good ESG data now, because many of your competitors may already have started doing so. Get the tools you need to do ESG right and capitalize on ESG opportunities before they become liabilities.

Let VelocityEHS Help!

Our ESG Solution, part of the VelocityEHS Accelerate® Platform, makes it easy for businesses like yours to track your GHG emissions. Our Utility Data Sync capabilities interface directly with your utility provider, collecting your energy consumption data at the source and automatically applying the correct emissions factors and unit conversions to minimize potential for error. You’ll get powerful data assurance and data integrity reporting to demonstrate that you’re maintaining investor grade data and give your investors and stakeholders confidence in your disclosures.

Simplified GHG reporting is only one of the benefits of our ESG solution. You’ll also get comprehensive ESG materiality assessment tools to identify and prioritize your most important ESG issues, easily deploy materiality surveys to your stakeholders, analyze their responses, and communicate results through an easy-to-understand materiality matrix.

Ready to learn more? Contact us anytime to find out how our software helps you build an ESG program that works.

The post France Has Adopted the CSRD and Will Fine, Jail Noncompliant Company Directors appeared first on VelocityEHS.

]]>The post Unleashing the Power of ESG Data: A Deep Dive with CVC appeared first on VelocityEHS.

]]>

The recent VelocityEHS ESG Virtual Conference featured an enlightening conversation between Roger Bottum, Senior Vice President of Product at VelocityEHS, and Marco Bartholdy, ESG Manager at CVC. The discussion delved into the intricacies of making ESG data investor-grade and shed light on its critical role in shaping the future of investments.

Understanding the Essence of ESG Data

From an investor’s standpoint, ESG data serves a dual purpose: evaluating the financial impact on investments and assessing the broader sustainability impact beyond financial metrics. Marco Bartholdy emphasized the importance of distinguishing between these perspectives, noting that sustainability data extends its influence on a wider audience, including regulators, employees, and affected communities.

Private equity firms, such as CVC, hold a unique position in this landscape. Unlike traditional investment classes, they can often take substantial stakes in smaller companies, allowing for greater influence on ESG management. For these firms, ESG data isn’t just a reporting requirement; it’s a crucial tool for measuring and managing the positive and negative impacts of ESG factors on the businesses they invest in, and it influences future investment decisions.

Navigating the ESG Landscape

One of the challenges organizations face is understanding how ESG data applies to them specifically. Bartholdy stressed the need for efficient data management, suggesting investments in technology and automation to streamline the data collection process. The importance of materiality assessments, to gauge both single and double materiality, was highlighted. Single materiality focuses on the financial impact of ESG topics, while double materiality also considers the broader impact on society, environment, and economy.

CVC uses materiality assessments to prioritize ESG topics based on stakeholder engagement, internal evaluations, and customer feedback. Businesses are encouraged to focus on data that is aligned with an organization’s impact on external issues.

Decoding Investor-Grade Data

Bartholdy emphasized the significance of investor-grade data in the modern business landscape. While sustainability data has existed for decades, its newfound importance requires a level of standardization and comparability. Current standards, such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the International Sustainability Standards Board (ISSB), represent a step in the right direction. The integration of recommendations from the Task Force on Climate-Related Financial Disclosures (TCFD) and the use of the GHG protocol for calculating carbon emissions add credibility to these frameworks.

Chief Financial Officers (CFOs) play a crucial role in controlling ESG data, necessitating their familiarity with emerging frameworks. The Corporate Sustainability Reporting Directive (CSRD), impacting companies immediately, and the International Sustainability Standards Board (ISSB), aligning sustainability reporting with financial reporting standards, are key frameworks to watch. The Global Reporting Initiative (GRI) remains a prominent voluntary reporting framework, focusing on double materiality.

Material Metrics for Investment Decisions

When it comes to deciding whether to invest, specific metrics take centre stage. While every investor may prioritize different factors, material topics such as climate change, diversity, equity, inclusion, and cybersecurity are among the most common considerations.

Efficiency in Data Collection

Efficiency in ESG data collection is paramount. Bartholdy urged companies to treat ESG data with the same rigor as financial data. Technology and automation play a vital role in managing data efficiently, enhancing collaboration with finance and reporting teams. Choosing the right software system tailored to the organization’s needs is crucial for effective data collection and reporting.

Emerging Trends in Sustainability Reporting

Looking ahead, Bartholdy emphasized the importance of letting strategy lead reporting. ESG and sustainability data should extend beyond the “carbon tunnel vision” and encompass broader priorities like nature and biodiversity. Strategic focus on stakeholder priorities ensures that the reported data holds value and contributes meaningfully to the organization’s sustainability goals.

In conclusion, the conversation between Roger Bottum and Marco Bartholdy provided valuable insights into the world of investor-grade ESG data. As organizations navigate the complexities of reporting, adopting best practices, leveraging technology, and staying abreast of evolving frameworks will be instrumental in creating a sustainable and transparent future for investments. The journey toward making ESG data investor-grade is not just a compliance requirement; it’s a strategic imperative for businesses seeking to thrive in a responsible and resilient global economy.

For the full, detailed expert discussion on investor grade ESG data, watch the on-demand session.

VelocityEHS Can Help!

The ESG Solution, part of the VelocityEHS Accelerate® Platform, gives you the support you need to obtain, manage, and report investment-grade ESG data. Our Utility Data Sync capability interfaces directly with your utility providers to automatically collect data, apply correct emission factors, and convert your data to the right units, minimizing potential for error and administrative burdens. The solution also gives you the ability to track all three scopes of your GHG emissions, with reporting capabilities aligned with major ESG disclosure frameworks.

Contact us today to learn more about how we can help you to improve your EHS & ESG programs.

The post Unleashing the Power of ESG Data: A Deep Dive with CVC appeared first on VelocityEHS.

]]>The post 2023 Top Five Most-Read Blogs! appeared first on VelocityEHS.

]]>

It’s important to us here at VelocityEHS that you have up-to-date information and expert advice you need to help build your knowledge, skills, and understanding of what’s happening in the world of EHS and environmental, social, and governance (ESG). Throughout the year we’ve shared around 75 blogs covering different topics to keep you informed in your EHS and ESG journey. We’ve rounded up the 2023 top five most-read blogs for you to revisit and share with others who can benefit from these insights.

1. Canada Issues Final Rule Updating Hazardous Products Regulations (HPR)

Get a better understanding of the update to Health Canada’s HPR final rule to align with the seventh revised edition of the United Nations Globally Harmonized System of Classification and Labelling of Chemicals (GHS). This blog reviews the background of the final rule, summarizes the key changes, and gives insights about what comes next. Read more.

2. What is Management of Change?

Many people are convinced they understand the meaning of Management of Change, but what actually goes into managing change? This blog gives an overview of what Management of Change is and how it’s an essential part of safety management. Learn more.

3. OSHA Recordkeeping: Answering Your Frequently Asked Questions

Sharpen your understanding of the OSHA Recordkeeping Standard, with answers from EHS and ESG Expert Phil Molé on some of the most frequently asked questions he receives during webinars and in-person speaking events, along with some other helpful resources. See the FAQ and answers.

4. Why Should ESG Matter to Me? Part One: EHS and Safety Managers

This blog helps to connect the dots between EHS and ESG, unpacking the ways ESG connects to the things EHS professionals are already doing now and explaining how building ESG maturity can make EHS management easier. Read on.

5. OSHA, EPA, Other Federal Civil Penalties Rise in 2023

Get a closer look at some of the 2023 updated civil penalties and fines from US federal agencies. This blog gives you the low down on why meeting compliance regulations is important, the rising costs for non-compliance, and how these changes could impact your business. Read the blog.

Remember, VelocityEHS Can Help in More Ways than One!

Having robust EHS and ESG management programs in place is just one aspect of cultivating a strong sustainable health and safety culture. The VelocityEHS Accelerate® Platform includes a wide range of innovative software solutions and built-in expertise to meet your toughest EHS and ESG challenges. Talk to one of our experts and discover how software can help make it easier for you to manage, maintain, and ensure long-term success.

The post 2023 Top Five Most-Read Blogs! appeared first on VelocityEHS.

]]>The post ESG Virtual Conference Session Summary: Ensuring Future Ready ESG Software Implementations appeared first on VelocityEHS.

]]>

An organization is future ready when it can anticipate and respond to emerging trends, advances in technology, and challenges. For EHS and ESG leaders looking to implement an ESG software solution, it’s important to consider future readiness during the process to ensure success. During the recent VelocityEHS ESG Virtual Conference, experts Daniel Sakrisson, Senior Vice President, and Shannon Wegesser, Associate Vice President from Velocity partner company WSP, shared insights on this topic. Read on to learn WSP’s perspectives on the key aspects of future readiness, strategies for software implementation, and common challenges and how to avoid them.

What Does It Mean to Be Future Ready?

To start off the session, Sakrisson describes the following six aspects as key components to future readiness and how the ESG software solution selected should be built upon using these six components.

- Resilient – Able to withstand and recover from unexpected disruptions

- Adaptable – Capable of integrating emerging technologies and have the flexibility to incorporate new tools and systems as they become available

- Innovative – Proactive in exploring new ideas

- Strategic – Develop long term strategies for future scenarios for agile decision making

- Improves – Acquire new skills and knowledge that will be valuable in evolving markets and industries

- Sustainable – Implement friendly solutions to address future environmental concerns

The Steps to Transformation

Sakirsson also explains that to become future ready, an organization will likely need to transform. He breaks down the transformation journey into these five steps:

- Determine vision: Where does the company want to go?

- Develop strategy: Where is the company at?

- Plan: How does the company get there?

- Implement: Creating the solution

- Deploy: Putting it into use

Strategies for ESG Software Implementation

Next, Wegesser discusses different strategies companies can use when implementing ESG software, which WSP groups into the following:

Big Bang

The Big Bang strategy is an “everything at once” approach that allows end users to set time aside for key activities and have the authority to make decisions for their programs.

Phased

The Phased strategy is a “piece-by-piece” approach that allows the organization implementing the software, its team, and its partners to focus on one area or deliverable at a time.

Pilot

The Pilot strategy is a “test the waters first” approach that allows end users to refine their internal process before involving a larger piece of the organization.

Iterative

The Iterative strategy is an “enhance over time” approach. This is a slower approach that allows each department to be heard in order to find mutual agreement with the purpose of driving towards organizational alignment over time.

Methodologies for ESG Software Implementation

In addition to outlining different implementation strategies, Wegesser covers the four most common methodologies WSP sees utilized with customers’ ESG software implementations. She emphasizes that it’s critical to do proper research before choosing a methodology and to be honest about what your organization will be able to adapt to. For example, it’s easy to visualize a perfect waterfall approach. However, does the company have the required staff, enough support, and the necessary resources to consistently meet all the criteria through the entire project? These are the types of questions an organization should be asking itself when considering the different methodologies summarized below.

Waterfall

The Waterfall methodology is a linear series of phases approach that focuses one iteration at a time, allowing each phase to be completed before moving on to the next. It is designed for discovery, design, development, testing, deployment, and maintenance.

Agile

The Agile methodology involves breaking the project into smaller and more management iterations.

Hybrid

The Hybrid methodology is an option in the middle of Agile and Waterfall. Aspects of the Waterfall methodology could be used for initial planning and requirement, while aspects of the Agile methodology could be applied for building and testing.

Scrum

The Scrum methodology is essentially an Agile methodology with fixed-length iterations. In other words, much like an Agile methodology, the Scrum methodology is broken down into manageable chunks called “sprints” for more focus on a specific project.

Common ESG Implementation Challenges and How to Avoid Them:

After a company chooses the right strategy and methodology for its ESG software implementation, WSP explains that it’s inevitable the company will face a few challenges along the journey. Below are five of the nine common implementation challenges Wegesser shares in the session along with WSP’s recommendations for overcoming them.

1. People are not available for the project. Given the subject matter expertise that is required for these deliveries, this can create delays or conflicts within the project. The best way to approach this challenge is to:

- Create a resourcing plan to identify key personnel for each step

- Book them ahead of time and track availability in routine project updates

- Ensure project status communication that includes upcoming availability

2. Requirements keep changing. Requirements could be changing due to regulations, acquisitions, or even new stakeholders. The best way to approach this challenge is to:

- Do a discovery project first to gather requirements

- Decide early if the project will be used to consolidate requirements in parallel to the build phase vs. gathering before starting the implementation

- Add a contingency fund

3. Data Quality. All quantitative data must be high grade quality data. The best way to approach this challenge is to:

- Make data quality review a part of the discovery and design phases

- Utilize templates with data integrity checks built in

- Define a process prior during design for dealing with non-conforming data and project impact / actions

4. Reports are not accounted for. At the end of the project, many organizations are unable to give their reports to their stakeholders. The best way to approach this challenge is to:

- Reverse engineer the build; design the system with the data output format in mind

- Have a separate “Reporting” task identified in the project schedule

5. No improvements are made after implementing. The best way to approach this challenge is to:

- Have a defined annual health check process

- Build post go-live support budgets

Markers of Success

How does a company know if it was successful with ensuring its ESG software is future ready? WSP shared some of the key markers of success, including:

- People actually use the software

- People feel empowered by the software

- People know how to use the software

- Reports and data are easily generated/found

- System notifications are just right

- Assigned actions get completed

- Processes are enforced and followed

- People can focus on analyzing the data instead of just collecting it

- Change management is an ongoing and clear process

Want to learn more? Click here to access an on-demand recording of the session.

Looking for Help?

Velocity’s partnership with WSP brings together the VelocityEHS Accelerate® Platform—the premier safety, sustainability and resilience cloud solution—with one of the industry’s biggest advisory and software implementation consultancies. This collaboration gives you easy access to best-in-class implementation support, ESG consulting services, and digital solutions wherever you operate. See how easy ESG can be—contact us today.

The post ESG Virtual Conference Session Summary: Ensuring Future Ready ESG Software Implementations appeared first on VelocityEHS.

]]>The post Start an ESG Program by Stepping into It Through Environmental Compliance appeared first on VelocityEHS.

]]>

Many companies around the world are required by laws and regulatory requirements, including those in their operating permits, to track and report on their waste management and environmental impacts to air and water. The act of identifying and managing these regulatory requirements is known as environmental compliance. If you’re an environmental, health, and safety (EHS) professional managing environmental compliance for your company, you’re already familiar with environmental reporting. And that means you’re also in an ideal position to evolve your environmental compliance program beyond compliance and integrate environmental, social, and governance (ESG) principles, and start fostering an ESG program.

Your environmental compliance program provides the framework needed for gathering necessary data to evaluate how well your company is maintaining compliance. You’re already tracking your company’s environmental impact and reporting this data at a very high level. In fact, your company’s sustainability reports are already probably using some of this data.

In addition to environmental compliance data, many sustainability reports include how companies are managing utility usage and greenhouse gas (GHG) emissions, which fall under the ESG umbrella. Plus, more ESG focused data will start finding its way into mandated disclosures. Expanding your environmental compliance program to measure utility usage and GHG emissions will elevate your company above compliance and give it a competitive edge.

If you’ve been following this “Step into ESG” blog series, you know there are multiple EHS frameworks to utilize to grow ESG maturity. These frameworks include safety, ergonomics, control of work, health, and operational risk. Environmental compliance is no different and is already greatly contributing to the environmental component of ESG. This blog will examine how your environmental compliance management framework has laid the foundation for an ESG program and what you can do now to prepare for the future.

Why is ESG Important?

Short answer—sustainability. Whether it’s environmental sustainability, social sustainability, corporate sustainability, or showing accountability for how you’re meeting these demands from your stakeholders, ESG plays a pivotal part in making sustainability happen.

ESG puts practices in place that help to protect the environment and people, while being transparent in how this is accomplished. It represents a set of criteria that investors, stakeholders, consumers, and soon governing bodies increasingly use to evaluate the impacts your company has on these resources. In order to truly build business resilience and growth in today’s marketplace ESG initiatives are becoming more essential and should no longer be considered a “nice-to-have,” but an integral business strategy for long-term success and a sustainable future.

Why is Environmental Compliance Important?

The answer is pretty simple—avoiding violations and fines, and the management deficiencies that lead to them. You are the one who makes sure your company adheres to the different governing laws and regulations in place to help protect the environment, ecosystems, and human well-being. This includes measures to control air emissions, waste management, and water quality. Managing an environmental compliance program can be complex and time-consuming but is necessary to avoid the penalties of non-compliance, such as massive fines and even prison, not to mention the impacts to our natural resources and your company’s reputation.

And then there are the reputational and marketplace risks that come with noncompliance, because regulatory agencies often make compliance history public, as EPA does with its Enforcement and Compliance History Online (ECHO) database.

Environmental compliance is a regulatory necessity. But built into this necessity comes the reward of protecting the environment and preventing harm to human health. There’s an intrinsic connection between environmental compliance and ESG because both strive to build a sustainable future through environmental preservation.

How Does Environmental Compliance Connect to ESG?

Environmental compliance is the cornerstone for responsible and sustainable practices. It’s an assurance that the environment and its resources are protected. Your environmental compliances management program greatly aligns with the environmental aspect of ESG while also helping to contribute to some of the social and governance components. You can have an environmental compliance management program while also further managing GHG and energy usage.

Growing Regulations for a Sustainable Future

Although there are laws and regulations that drive environmental compliance it is one of the first steps to build a mature ESG program. You’re already managing air, water, and waste by gathering the data to show you’re meeting necessary requirements. Why not expand on this data and start tracking your company’s energy usage and GHG emissions? You can move beyond compliance and help position your company to be more competitive in the ESG landscape.

The environmental pillar of ESG involves not just meeting compliance regulations but taking the next step by reducing the impact your company has on the environment. This means putting policies and practices in place to minimize GHG and air emissions, conserve resources, improve water quality, and reduce waste.

New 2024 Regulations

With the growing concern for sustainability there are some laws and regulations going into effect in 2024 that will require ESG disclosures along with environmental compliance. For example, the EU Corporate Sustainability Reporting Directive (CSRD) will require ESG disclosures on a range of issues, including climate risks and GHG emissions, biodiversity, air and water pollution, and management of risks and opportunities related to value chain workers, from approximately 50,000 EU and EU-listed companies. Affected companies will need to prepare and submit their disclosures based on the European Sustainability Reporting Standards (ESRSs) developed by European Financial Reporting Advisory Group (EFRAG).

The largest of these companies (in terms of financial performance and number of employees) will need to start collecting data in 2024 for inclusion on 2025 disclosures. Even if your company isn’t currently going to be affected, these new regulations will have a trickledown effect. Plus, stakeholders are increasingly expecting and demanding that the companies they do business with demonstrate similar accountability for their ESG performance by preparing disclosures.

You should also keep in mind that one of your customers could be required to submit ESG disclosures and account for their supply chain, which might include your company. If you’ve already taken action to incorporate ESG initiatives into your environmental compliance program, you’ve positioned your company to meet your customer’s needs and potentially gain new ones.

Leveraging Chemical Management to Reduce Waste

Another approach to getting ahead of growing regulations is through reducing your company’s generation of hazardous waste. One way to go about this is through better chemical management. This is because some chemicals become hazardous waste at the end of their cycle based on ingredients or specific characteristics, while others do not. Implementing modern green chemistry practices is a strategic approach to build ESG and reduce hazardous waste by selecting safer, more sustainable chemical products, including those that do not become hazardous waste after use.